next js stripe

stripe integration

nextjs payments

ecommerce

payment setup

Next JS Stripe Integration: Complete Payment Setup Guide

Why Next.js Stripe Is Your Secret Weapon For Payment Success

Building a robust and reliable payment system is mission-critical for any online business. A frustrating checkout process can lead to cart abandonment and a significant hit to your revenue. That’s why the powerful combination of Next.js and Stripe is becoming the go-to solution for many businesses. Experienced developers are increasingly leveraging this duo to build payment systems that are both seamless and customer-centric.

Next.js, a popular React framework, offers server-side rendering (SSR), enabling faster page loads. This speed is especially important for checkout pages, where every second counts. Additionally, SSR boosts SEO, improving your site’s visibility to potential customers. A fast, accessible site directly translates into more conversions.

Stripe, a leading payment gateway, integrates seamlessly with Next.js. This integration simplifies development, freeing up developers to focus on building unique features instead of wrestling with complex payment infrastructure. This ease of integration is a key reason why developers choose this powerful stack. Stripe’s robust features, like support for multiple payment methods and subscription management, make it a versatile solution for businesses of all sizes. Want to see how Stripe compares to other payment gateways? Check out this helpful guide: How to master Payment Provider Comparisons.

This powerful combination of Next.js and Stripe delivers significant advantages in performance, security, and developer productivity. The seamless integration of Stripe Checkout with Next.js has been instrumental in the global growth of online businesses. Tutorials and developer guides highlight how Next.js developers can implement Stripe payments with minimal setup time—often in under an hour for basic payment flows. Learn more about how quickly you can integrate Stripe Checkout with Next.js. This rapid implementation means faster time to market and reduced development costs.

Benefits of Using Next.js With Stripe

Beyond ease of implementation, the Next.js and Stripe integration offers a range of benefits:

-

Enhanced Security: Stripe’s robust security infrastructure, coupled with Next.js’s server-side rendering, creates a secure checkout experience, minimizing vulnerabilities and building customer trust. This combined approach helps reduce the risk of fraud and protects sensitive data.

-

Improved Performance: Faster page loads through SSR contribute to lower bounce rates and higher conversion rates. This translates to a better user experience and a positive impact on your bottom line.

-

Simplified Development: Streamlined integration and comprehensive documentation make the development process faster and more efficient, allowing developers to focus on other crucial aspects of your application.

-

Scalability: Both Next.js and Stripe are designed to scale as your business grows, handling increasing traffic and transaction volumes without impacting performance.

By choosing Next.js and Stripe, you're not simply selecting a payment system; you’re investing in a platform that empowers your business for growth and future success. This combination offers the performance, security, and developer-friendly tools you need to create a payment infrastructure that’s both robust and manageable.

Getting Your Next JS Stripe Foundation Right

A solid foundation is key for any successful project. Integrating Stripe with your Next.js application is no different. A well-structured setup ensures smooth payment processing, easy maintenance, and robust security. Let's explore the essentials, from securing your API keys to optimizing your project structure.

Setting Up Your Stripe Account and API Keys

First, create a Stripe account. This process is straightforward and gives you the tools to manage your payments. After setup, retrieve your API keys. These keys are the connection between your Next.js application and Stripe, enabling secure communication and transactions. Keep your secret key confidential—never expose it in client-side code. Use environment variables for secure storage.

For more on handling sensitive data, check out this article: How to master Next.js API Endpoints.

Configuring Webhooks for Real-Time Updates

Webhooks are vital for real-time communication from Stripe. They notify your Next.js application of events like successful payments, failed transactions, and subscription updates. This automation helps with tasks like order fulfillment, email notifications, and subscription management. Proper webhook configuration means you'll never miss a crucial payment event.

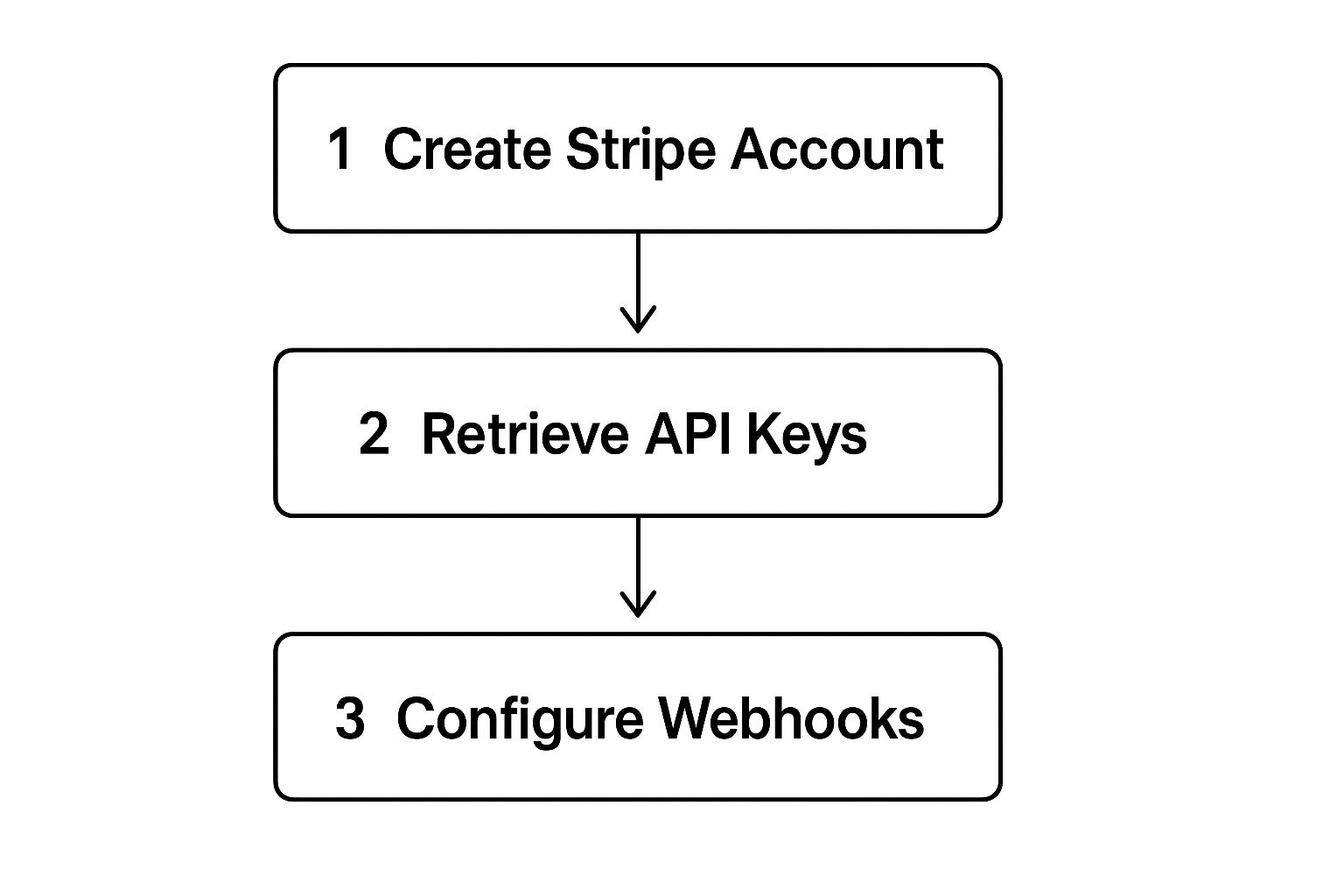

The following infographic illustrates the fundamental Stripe setup workflow:

As shown, robust Next.js Stripe integration starts with creating a Stripe account, securing your API keys, and configuring webhooks for payment event updates. This builds a reliable payment system from the outset.

Project Organization and Security Best Practices

A well-organized project simplifies development and maintenance. Create dedicated folders for Stripe-related code, including API routes, webhook handlers, and utility functions. This modular design encourages code reusability and simplifies debugging. Prioritize security: validate user inputs, implement proper authentication, and adhere to Stripe’s security best practices.

Environment Configuration for Seamless Scaling

Proper Next.js environment configuration is essential for scalability. Manage sensitive data and configure your application for different environments (development, staging, production) using environment variables. This prepares your payment system for increasing traffic and transactions as your business grows. A well-defined environment setup ensures seamless transitions between development and deployment stages.

The following checklist summarizes the key steps for setting up Stripe in your Next.js project:

Before we dive into the specifics of each step, let's take a look at a high-level overview of the process:

| Setup Step | Description | Required Files | Environment |

|---|---|---|---|

| Create Stripe Account | Set up a Stripe account to access the dashboard and API keys. | N/A | N/A |

| Obtain API Keys | Retrieve your publishable and secret keys for secure communication. | .env.local, .env.* | Development, Production |

| Install Stripe Library | Install the necessary Stripe library for your Next.js project. | package.json | Development, Production |

| Set up API Routes | Create serverless functions to handle Stripe API requests. | pages/api/stripe/* | Development, Production |

| Configure Webhooks | Set up webhooks to receive real-time updates from Stripe. | pages/api/webhooks/* | Development, Production |

| Implement Client-Side Logic | Integrate Stripe.js for handling client-side payment interactions. | components/* | Development, Production |

This table provides a concise overview of the steps, files, and environments necessary for a successful Stripe integration. By following these best practices, you'll create a secure, scalable, and maintainable Next.js Stripe integration, setting your business up for efficient payment processing and allowing your development team to focus on innovation.

Building Checkout Experiences That Actually Convert

Turning casual browsers into paying customers relies heavily on a smooth and trustworthy checkout experience. This involves understanding not only the technical aspects of implementing Next.js and Stripe, but also the psychology of online shoppers. Let's explore some effective strategies used by successful e-commerce sites to optimize their checkout process and boost conversions.

Optimizing For Speed and Simplicity

A slow or complex checkout is a major reason for cart abandonment. Every extra click or delay can discourage a potential buyer. Next.js, with its server-side rendering (SSR) capabilities, offers the speed needed for a seamless experience. This translates to faster loading times, particularly on mobile, which is crucial in our increasingly mobile world. Combine this with Stripe's streamlined checkout, and you have a powerful formula for keeping customers engaged.

Customization For Different Product Types

A uniform checkout experience doesn't work for every product. Digital downloads, physical items, and subscriptions each have their own specific needs. Tailor your checkout flow to match the product type. For instance, a subscription service might require a clear display of recurring billing details. For physical products, showing shipping costs upfront and providing different delivery choices is vital. This transparency builds trust and encourages purchases.

This is especially relevant with Next.js and Stripe, as their flexible integration allows for highly personalized checkout flows. The adoption of Stripe in Next.js e-commerce has seen significant growth thanks to its seamless payment processing and subscription features. Data from the developer community in late 2024 indicates that integrating Stripe with Next.js reduced checkout completion times by roughly 30%, directly impacting conversion rates for online businesses. For more detailed data, see: Stripe with Next.js. This demonstrates the positive effects of a well-designed checkout on conversion rates.

Handling Multiple Payment Methods

Providing various payment options caters to a broader audience and simplifies the checkout process. Stripe supports numerous payment methods, from traditional credit and debit cards to digital wallets. Integrating these with your Next.js application is relatively easy. Be careful not to overwhelm customers with too many options, though. Offer a curated list of the most relevant payment methods for your target audience.

Mobile Optimization and Accessibility

Given today's mobile-first environment, ensuring your checkout is mobile-friendly is crucial. A responsive design that adapts to various screen sizes is essential. Furthermore, prioritize accessibility for users with disabilities. Adhering to accessibility standards not only enhances the experience for everyone but also broadens your potential customer base.

For more on Stripe integration, see: How to master Stripe Integration. Implementing these strategies can lead to a checkout experience that not only looks good but also works effectively, prompting more customers to complete their purchases and, ultimately, improving your conversion rates.

Scaling Subscription Services Without The Headaches

Building a successful subscription service requires more than just processing one-time payments. It demands a system that can handle the complexities of recurring billing, manage customer subscriptions, and adapt to evolving business needs. This is where the flexibility and robustness of Next.js and Stripe become invaluable.

Architecting for Subscription Success

A well-structured architecture is the foundation of any scalable subscription service. Separate your concerns by creating distinct modules for handling subscription creation, updates, cancellations, and payment processing. This modular approach simplifies code maintenance and debugging as your subscription offerings expand.

For instance, consider a separate module for proration logic when customers upgrade or downgrade their subscriptions. This keeps your code organized and manageable. Leverage Stripe’s webhooks to receive real-time updates on subscription events. This automation is key to scaling efficiently. You can automate tasks like sending renewal reminders, updating customer access, and managing failed payments.

Empowering Customers With a Self-Serve Portal

Reduce support tickets and empower your customers by offering a self-serve portal built with Next.js. Allow customers to manage their subscriptions, update payment information, and view their billing history directly. This not only improves customer satisfaction but also frees up your team's time.

Features like pausing or resuming subscriptions can significantly reduce customer churn. Providing customers with control over their subscriptions contributes to a positive user experience.

Handling Complex Billing Scenarios

Subscription services often involve intricate billing scenarios beyond simple monthly plans. Next.js and Stripe offer the flexibility to handle these complexities effectively. Implement usage-based billing, tiered pricing, and prorated upgrades/downgrades to accommodate various business models.

Thorough testing and clear documentation of your billing logic are essential for preventing unexpected problems. Effectively handling edge cases, such as failed payments and subscription cancellations, ensures a smooth customer experience. Building in this flexibility from the outset is more efficient than trying to add these features later.

One historical milestone in integrating Stripe with Next.js is the evolution of subscription-based payment models. By early 2025, Next.js 15 introduced advanced features enabling developers to implement Stripe subscriptions with a more streamlined approach. Explore this topic further

Automating Engagement and Retention

Keeping subscribers engaged is essential for long-term success. Use Next.js to create automated email sequences that welcome new subscribers, offer helpful tips, and provide exclusive content. These automated interactions can drastically improve customer retention.

Integrating Stripe’s subscription events with your email marketing platform enables targeted and timely communication. This proactive approach keeps your customers informed and engaged, ultimately boosting your recurring revenue.

Mastering Webhooks For Bulletproof Payment Processing

Stop losing sleep over missed payments and failed transactions. Reliable payment processing depends on robust webhook handling. This section reveals how to build webhook systems with Next.js and Stripe that reliably handle every payment event, even under heavy load. We'll draw on practical examples from developers processing thousands of transactions daily.

Understanding The Importance of Webhooks In Next.js Stripe Integration

Webhooks act as real-time messengers between Stripe and your Next.js application. They provide instant notifications about important payment events, like successful charges, refunds, and subscription updates. This eliminates the need for constant polling, reducing server load and ensuring you always have the most current information. Think of webhooks as automated updates delivering crucial data the moment it happens.

Essential Stripe Webhook Events And Their Implementation

Different webhook events correspond to various stages of the payment process. Knowing which ones to prioritize is key to building a robust payment system. The following table outlines some of the most important events to consider.

To help you prioritize and implement the right webhooks, we've compiled a table summarizing key Stripe webhook events and their impact on your Next.js applications.

| Event Type | Purpose | Implementation Priority | Business Impact |

|---|---|---|---|

payment_intent.succeeded | Confirms successful payment | High | Triggers order fulfillment, updates inventory |

payment_intent.payment_failed | Notifies of failed payments | High | Alerts customer, allows for retry |

customer.subscription.created | Signals new subscription | High | Grants access to content, updates billing |

customer.subscription.updated | Indicates subscription changes | Medium | Manages upgrades, downgrades, pauses |

customer.subscription.deleted | Notifies of cancellations | High | Revokes access, updates records |

charge.refunded | Signals a refund | Medium | Processes refunds, updates customer balance |

By prioritizing these events, your Next.js application can respond appropriately to critical payment actions. This is essential for maintaining data consistency and a smooth customer experience.

Building Reliable Webhook Handlers In Your Next.js Application

Your Next.js application needs dedicated API routes to receive and process these webhook events. These webhook handlers are the backbone of your system. They receive data from Stripe, validate its authenticity, and trigger the necessary actions within your application. For instance, a payment_intent.succeeded webhook might trigger an order fulfillment process.

Building these handlers within the /pages/api directory of your Next.js project enables server-side processing. This ensures secure handling of sensitive data and integration with your backend logic.

Securing Your Webhook Endpoints And Implementing Error Handling

Security is paramount when dealing with webhooks. You must verify that incoming requests originate from Stripe. Stripe provides signing secrets for this very reason. Your webhook handlers should verify these signatures to prevent malicious actors from sending fake events.

Robust error handling is also vital. Your system should gracefully handle failed webhook deliveries to prevent data inconsistencies. Implementing retries and logging mechanisms ensures no payment event goes unnoticed.

Imagine your webhook handler failing silently during a crucial payment. This could lead to lost revenue and unhappy customers. Proper error handling isn't optional; it’s a necessity. These practices ensure your Next.js and Stripe integration remains secure and reliable, processing payments efficiently and maintaining accurate records.

Security And Performance That Builds Customer Trust

Your payment system's security is paramount. A single vulnerability can erode customer trust and severely damage your reputation. This section explores vital security practices and performance optimizations that set professional payment systems apart. We'll draw upon expert insights to help you protect sensitive data while ensuring a seamless and fast checkout experience.

Encryption and Compliance

Protecting customer data requires robust encryption. Implement HTTPS across your entire application, ensuring all communication between your Next.js frontend and your Stripe backend is encrypted. Employ strong encryption algorithms when storing sensitive information such as credit card details and personally identifiable information (PII).

Adhering to industry standards like PCI DSS is crucial for any business handling payment information. These standards provide a framework for securing cardholder data and minimizing the risk of breaches.

API Key Management and Secure Storage

Your Stripe API keys, especially the secret key, are critical. Never expose your secret key in client-side code. Securely store them using environment variables. For added security, consider using a secrets management service.

Regularly rotating your API keys minimizes the impact of potential compromises. This practice is similar to changing your locks periodically for enhanced home security.

Database Optimization and Performance Tuning

A slow database can negatively impact your checkout process, leading to increased cart abandonment. Optimize your database queries and schema for performance. Implement caching strategies to reduce database load.

Use a Content Delivery Network (CDN) to serve static assets quickly, reducing latency and improving the overall checkout speed. Mastering webhooks is also vital for robust payment processing with Stripe. For broader webhook utility, explore information on Notion Webhooks.

Monitoring and Threat Detection

A secure system demands constant vigilance. Implement robust monitoring to track key performance indicators (KPIs) such as checkout completion times and error rates. Utilize intrusion detection systems to identify and address security threats promptly.

Regular security audits and penetration testing can help uncover vulnerabilities before exploitation. Consider these as routine health checkups for your payment system.

Performance Optimization for Reduced Cart Abandonment

Speed is key to a positive user experience. Optimize your Next.js application for performance. Minimize the size of your JavaScript bundles to reduce loading times. Use image optimization techniques to improve page speed. Implement lazy loading for images and other non-critical resources.

A fast checkout process reduces friction and encourages purchase completion. Every second saved can contribute to increased revenue.

By adhering to these security and performance best practices, you'll build a payment system that is not only robust and reliable, but also fosters customer trust. This foundation is essential for long-term success in the competitive online marketplace. Investing in security and performance is an investment in the future of your business.

Key Takeaways

Building a successful payment system with Next.js and Stripe involves several crucial steps. From initial setup to ongoing maintenance, understanding key concepts and best practices is essential for a smooth and secure payment experience. This section offers practical advice gleaned from real-world implementations and developer experiences, providing a roadmap for your Next.js and Stripe integration success.

Secure Your Foundation

-

API Key Protection: Securely store your Stripe API keys, especially the secret key, using environment variables. This fundamental step protects your account and prevents unauthorized access. It's like safeguarding the keys to your storefront.

-

Webhook Verification: Verify the authenticity of webhook events using Stripe's signing secrets. This ensures incoming data originates from Stripe and not malicious actors. Think of it as verifying a delivery driver's credentials before accepting a shipment.

-

Organized Project Structure: Maintain a well-organized project structure, separating concerns into dedicated modules. This improves code maintainability and simplifies debugging, much like a well-organized toolbox allows you to quickly find the right tool.

Optimize for Conversions

-

Streamlined Checkout: A fast and simple checkout is vital. Minimize the steps required for customers to complete purchases. This reduces friction and encourages conversions, smoothing the path to purchase.

-

Mobile-First Approach: Optimize your checkout for mobile devices. A responsive design that adapts to various screen sizes is crucial.

-

Multiple Payment Options: Offer various payment methods to cater to a wider audience and boost conversion rates. Security is paramount; for more information, explore this guide on security best practices.

Scale Your Subscriptions

-

Flexible Architecture: Design your subscription system with scalability in mind. A modular approach allows you to add new features and handle complex billing scenarios with ease. It's like building with blocks, enabling effortless adaptation and expansion.

-

Customer Self-Service: Empower customers with a self-service portal to manage subscriptions, update payment information, and view billing history. This reduces support overhead and improves customer satisfaction.

Ensure Reliability and Security

-

Robust Webhook Handling: Implement reliable webhook handlers to process payment events and trigger actions within your application. This automation is crucial for efficient payment management.

-

Error Handling and Logging: Implement comprehensive error handling and logging to catch issues early and prevent data inconsistencies. This acts as a safety net for your payment system.

-

Performance Monitoring: Continuously monitor your system's performance to identify and address bottlenecks, maintaining a fast and efficient checkout experience.

Ongoing Maintenance and Optimization

-

Regular Security Audits: Perform regular security audits to identify and address potential vulnerabilities. This is akin to routine car maintenance, ensuring smooth operation.

-

Performance Tuning: Continuously optimize your application's performance to improve loading times and reduce cart abandonment.

-

Stay Updated: Keep your Next.js and Stripe integrations current to leverage the latest features and security enhancements.

By implementing these key takeaways, you can build a robust, secure, and scalable payment system with Next.js and Stripe, positioning your business for success. Start building the payment infrastructure your business deserves today.

Ready to launch your AI-powered projects faster? Check out AnotherWrapper, the comprehensive Next.js AI starter kit.

Fekri